How To Tackle Customer Vulnerability and Achieve Service Excellence

How To Tackle Customer Vulnerability and Achieve Service Excellence

How To Tackle Customer Vulnerability and Achieve Service Excellence

Feb 7, 2022

Eric Brown | Manager, Solutions Consultants

Eric Brown | Manager, Solutions Consultants

The issue of customer vulnerability isn’t going anywhere any time soon. The UK’s Financial Conduct Authority’s (FCA) Financial Lives Research in 2020 found that a staggering 27.7 million adults in the UK now have characteristics of vulnerability. Add to this the prediction that 75% of customer service and support calls will be due to loneliness by 2026, and you can see why some are warning of a looming vulnerability pandemic.

For the financial services sector in particular, faced with tackling compliance with the FCA’s vulnerability guidance, not to mention its forthcoming Consumer Duty, ensuring the fair treatment of vulnerable customers is one of the key challenges in both the short and long term.

Compliance isn’t the only driver for safeguarding vulnerable customers. If your organization doesn’t treat vulnerable customers fairly, you run the risk of not only regulatory fines, but potentially irreparable brand damage and consumer harm. As well, Corporate Social Responsibility (CSR) values have a huge role to play, with the fair treatment of vulnerable customers often fulfilling your firm’s mission and social purpose, not to mention upholding your brand values.

There are six key areas or ‘vulnerability pillars’ that you need to tackle to fulfil your responsibilities towards vulnerable customers:

Understanding customer needs

Skills and capabilities

Product and service design

Customer service

Communications

Monitoring and evaluation

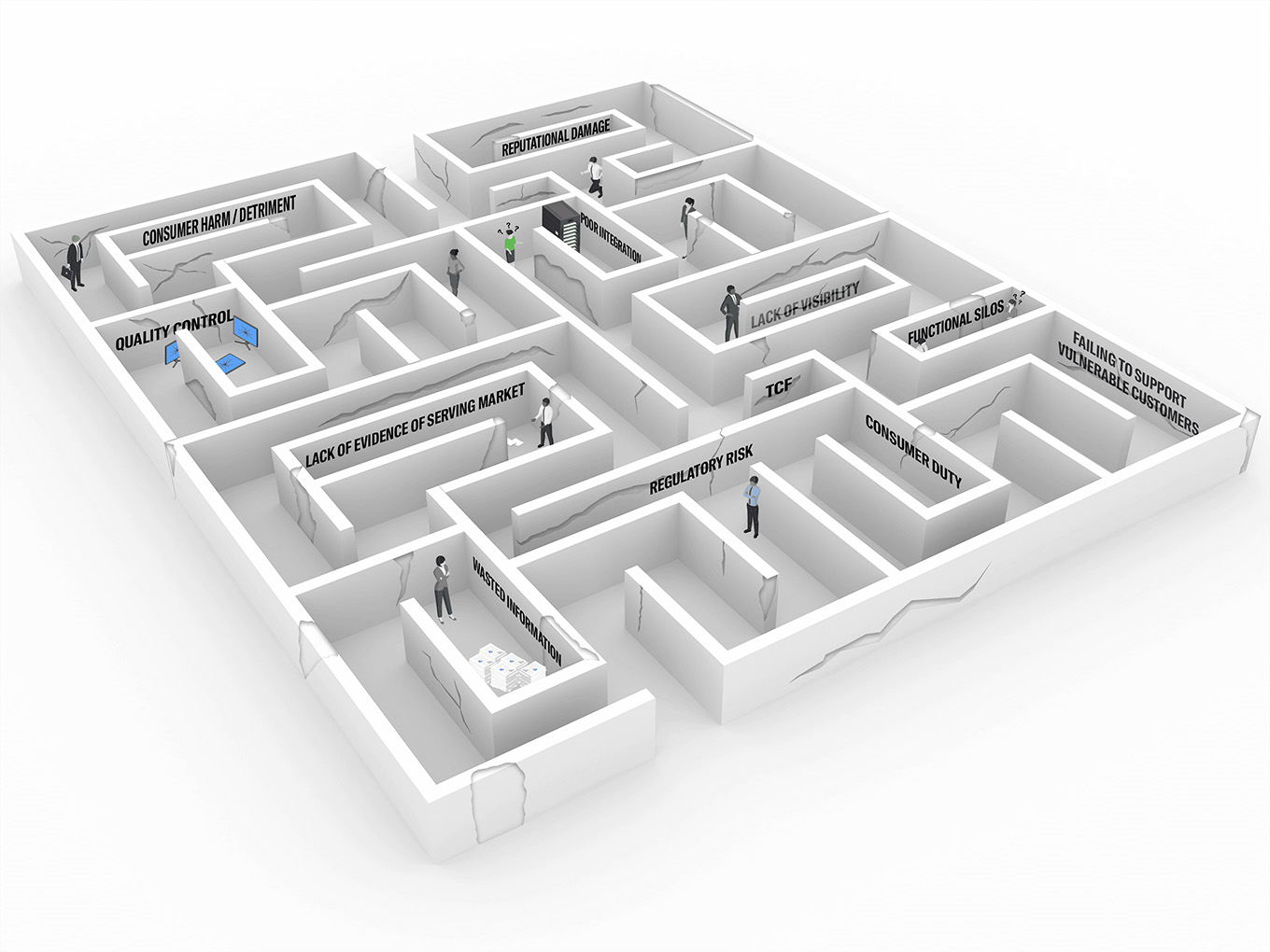

Even with the bests laid plans, we’re seeing more organizations struggling to manage their responsibilities to vulnerable customers, failing to get to grips with these core vulnerability pillars across all areas of the business.

Even the smallest cracks represent a real risk to your organization and customers themselves, creating a situation where vulnerable customers (and those customers who are potentially vulnerable) aren’t treated fairly and often aren’t even correctly identified as vulnerable in the first place.

So, why is it so hard to get right? Well, it’s a multi-faceted issue, exacerbated by a number of different factors. As such, what’s needed is a multi-faceted approach, employing a combination of best practices to not only identify customer vulnerability but to treat customers according to their individual circumstances too. Done correctly, what results is an efficient and empathic customer journey, for all.

Training Is Key

Top of the priority list should be training, and not just a one-off vulnerability training exercise either. Maintaining the right skills and capabilities across your workforce is a continuum and should be led from the top and by example. Helping staff to recognize the signs of vulnerability is a must, as is knowing how to treat customers in-line with their particular vulnerability. Empathy training is also paramount, giving staff the skills needed to communicate effectively and appropriately.

Sharing knowledge and skills within your organization is also crucial. Typically, complaint teams are well versed in identifying and supporting vulnerable customers, trained to perhaps a higher standard than other areas of the organization. It’s important to leverage this expertise, applying lessons learned to the wider organization to establish a culture of continuous improvement when it comes to customer vulnerability.

The right solutions can augment staff skills too, with intuitive solutions available to support every stage of the customer journey, supplementing skill sets with intelligent workflows to ensure optimum outcomes for customers, whatever their circumstances. Vulnerability detection functionality is also extremely helpful, boosting the capabilities of an already skilled workforce to ensure no vulnerable customers slip through the net.

Unlock Your Data

What many businesses don’t realize is that they already have the data needed to improve the treatment of vulnerable customers. You can glean valuable information from every customer interaction, from initial enquiry, via the complaints process, and through to customer feedback surveys. Information that can and should be leveraged to support your understanding of your customer base from a vulnerability perspective.

The problem we see is that too much of this information is held in data silos. By unlocking this data, be it in CRM systems, claims management solutions, or complaint management systems and amalgamating it into a single, accessible, centralized source, it’s possible to build-up a comprehensive picture of just what vulnerability looks like among your customer base. Doing this helps to inform business learnings, providing the insight needed to ensure processes and procedures evolve in-line with changing customer requirements.

Optimize Your Systems

It’s a similar story with systems. Too many organizations use a plethora of disparate technologies and solutions that simply don’t communicate with each other. In short, the left hand doesn’t know what the right hand is doing, which all too often leads to customers identified as vulnerable in one area of the business slipping through the vulnerability net when dealing with a different department or business function. There’s a real need to join-up and integrate systems, sharing capabilities and information right across the customer journey.

Create an Excellent Customer Journey

You need to do what you can to make interactions as easy as possible for customers, creating an excellent customer experience at every step of the way. For example, is it as easy for your customers to make a complaint as it is for them to buy one of your products or services in the first place? Businesses spend a lot of money to improve the digital customer journey but this needs to extend across every touchpoint, making the end-to-end customer journey as frictionless as possible.

Demonstrate Effective Processes and Outcomes

Having implemented changes to facilitate the fair treatment of vulnerable customers, it’s vital that you can demonstrate to the FCA how your business model, actions and culture all contribute to achieving this goal. For example, with a robust complaint management system in place, one which provides vulnerability detection in combination with a whole host of other capabilities to support your vulnerable customers, you can demonstrate the processes you employ as well as the results you’re achieving. It’s all very well claiming to protect your vulnerable customers but can you demonstrate exactly how you’re doing it and the effect your efforts are having?

By taking a holistic look at your operations, it’s possible to build an organization that meets and even exceeds its responsibilities, both regulatory and morally. Optimizing systems and leveraging the data available via a highly skilled and empathic workforce ensures the fair treatment of vulnerable customers at every step of the customer journey, nurturing an efficient, responsive and customer-centric business culture, while protecting and safeguarding those who need it most.

For more information on how your organization can leverage Aptean’s complaint management system to ensure the fair treatment of vulnerable customers, download our eBook Putting FCA Vulnerability Guidance Into Practice or contact us today.

¿Todo listo para transformar tu negocio?

Tenemos las soluciones ERP especializadas que necesitas para superar los desafíos de tu sector.